Is there any trick of trade behind the many eye-popping but hard to believe upward trajectories witnessed in valuations of many e-commerce ventures?

E-commerce start-ups, which fail to get going, are a common story. May be, they are not considered worth writing about. Certainly, the rising valuations of many e-commerce start-ups make them the blue-eyed boys of the markets. Hence, they are the talk of the town. Everyone wants to get a whiff of their mantra for success. Significant numbers of start-ups fail to muster even basic incubator support which probably would have enabled them to make that one last sprint towards glory. Amidst such a scenario, where valuations of certain start-ups continue to soar against the winds opinion abounds. Market analysts occupy left, right and centre while justifying their opinions on the sanctity of such valuations. Why there is no end to the queue of investors eager to bet on such ventures? The answer lies in dressing up properly and it certainly is not any rocket science.

To understand the rationale of think-tanks behind such sky-high valuations, I tried to sneak a peek into the working of such start-ups and incubators, considered to be dominant players, to try and make sense of their rising valuations.

Studying of financial statements of some of these incubators/investors, reminded me of old–school techniques to pump up valuation. Such a technique has been the preferred choice among promoters of many companies around the world and it banks on innovative structures so that the venture, despite the infirmities, continues all dressed up to touch the peak.

This story has many chapters. Unrealistic valuation is not the last chapter. Higher valuation is not the end result. Instead, it’s a means to achieve those ends. Higher and continuously growing valuations mean higher investments and probability of getting a thumping entry on the bourses thus providing the right opportunity for the investors to book healthy returns when the time comes. A realistic valuation doesn’t promise such grand exit.

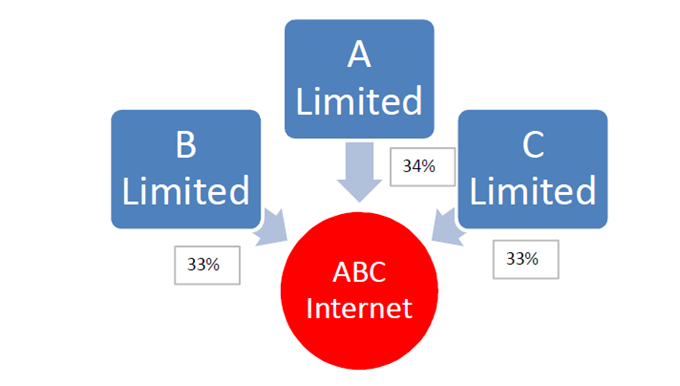

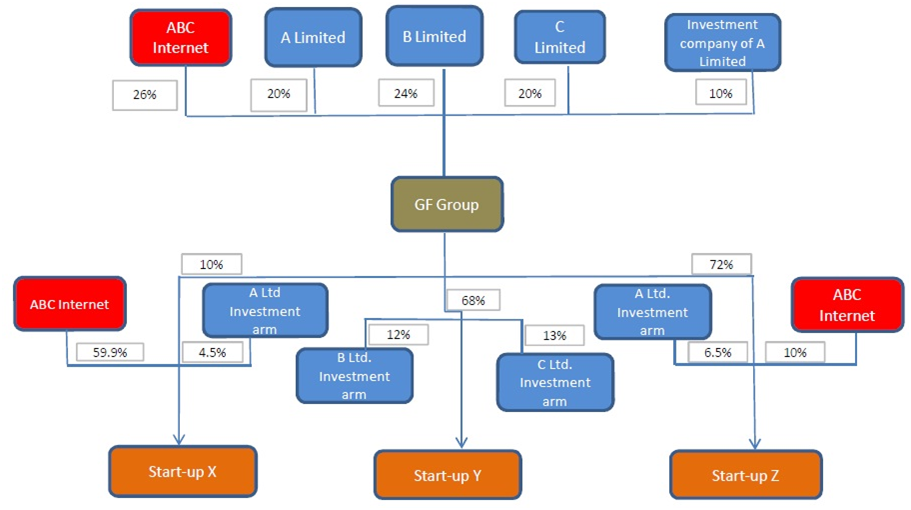

Somewhere in the first decade of the new millennium was born a global incubator. The global incubator aimed very high and for this, aggressively expanded its wings across the globe. This flight of fancy spawned a whole new genre of corporate structures ensuring a rosy picture perceived as a glowing opportunity to investors, who were apparently unwilling to let go piece of the pie in the e-commerce industry but seemed hesitant to place their money in a sector that still continues to remain largely unknown and unchartered. Let’s try to understand to entire structure by way of simple flow charts. Here Incubator ABC Internet is being formed by a group of investors namely A Ltd., B Ltd. and C Ltd. ABC Internet and its subsidiary namely GF Group has invested into three start-ups X, Y and Z. The steps of such valuation doping can be crystalised as under:

-

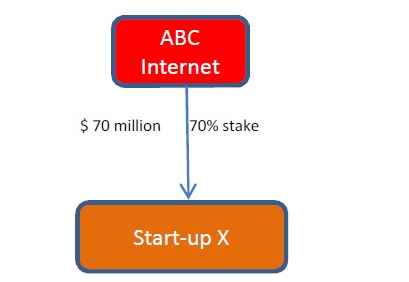

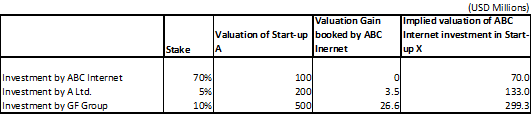

The incubator, which is a small group of investors, selects a promising start-up. Gives a valuation of the start-up. Let’s assume the valuation tag to be that of $ 100 million.

-

Now, the incubator strikes a deal to purchase equity/control in the start-up on the basis of $ 100 million valuation figure. For example, the incubator invests $ 70 million to get 70% stake in the start-up.

-

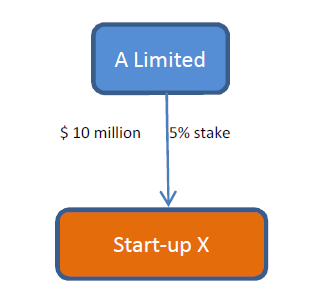

One of the investor from amongst the group of investors supporting incubator pours more fund say $ 10 million in start-up at a new valuation of $200 million.

-

The incubator itself forms a subsidiary. The stakes in this subsidiary is further sold to the same group of investors that owns/supports the incubator.

-

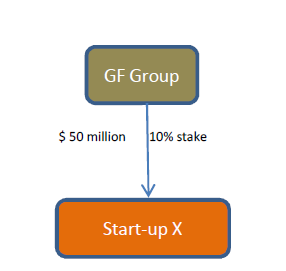

Now the subsidiary decides to go for a stake in the start-up. Once again, prior to the deal a new valuation tag is worked out. For instance, the new valuation of the start-up might now be pegged at $ 500 million. Meaning thereby that now the value of stake in the start-up is up for grabs but at a higher price. Now, the subsidiary picks up a stake in the start-up at the new valuation.

-

Apart from helping supplement the health of the start-up, irrespective of ground realities, the buying by the subsidiary at higher valuation, helps the incubator boast of making the right investment decision on the basis of latest value of the portfolio (which they claim a third party ascribed valuation).

-

The trick here is that the same people, who had invested earlier at a lower valuation, are indirectly investing at a higher valuation to put a stamp of masterstroke on their first decision to invest in the start-up. Incubator now re-states implied value of investments based on so-called third party valuation. Incubator also books valuation gain on dilution of its stake in above two instances.

-

The trick dresses up everyone’s books and makes the start-up feel like a suitable choice. At this point, amidst such a rosy scenario, the original investors/incubator alongwith its subsidiaries have the option of off-loading their stakes to some other investor dazzled by the beam of eye-popping valuation or get the company listed publicly on bourses. Besides enabling the incubator to go laughing to the bank with billions in kitty, this also helps them mask their misplaced bets.

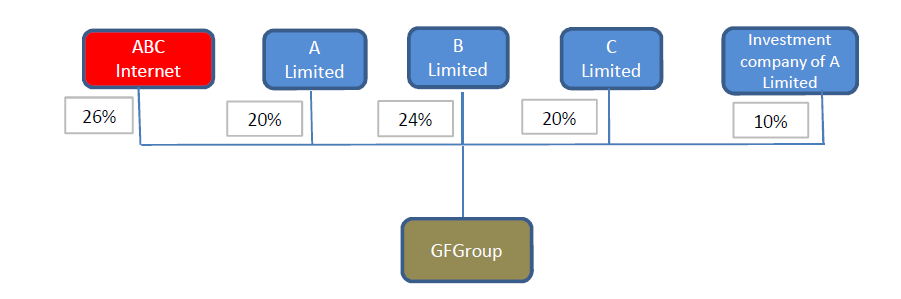

Now if the above structure is implemented in, for instance, three start-ups the final stake chart looks like this:

This valuation merry-go-round goes on, till the final objective of unlocking investment in these start-ups is achieved. Value unlocking happens either by selling start-ups to some other investor or to get it listed on the stock exchanges. As a result of this innovative structure, promoters of the incubation fund can hope for hefty return on investment they made in incubation fund, new entities (incubator’s subsidiaries) and their own books of accounts.

Cheers!

Nitin Mangal

SEBI Registered Research Analyst (INH000004723)

Your feedback will be highly appreciated. You may reach me at nitin@nmadvisors.com

Interesting times

LikeLike

Nice Post

LikeLike

Well said Mr. Nitin . The truth behind the big game .

LikeLike

At last somebody could simplify the tricks of the trade !

LikeLike

Nice research

LikeLike

Good work !!

LikeLike

Good stuff to understand the game

LikeLike